Table of Contents

Imagine your final grade depended on finding one key sentence. You must read a thousand books in a single week. For decades, this was life for junior investment bankers closing big deals. They analyzed thousands of legal papers, financial reports, and market data. This slow process consumed entire teams for weeks.

Now, one technology performs that same work in minutes. That is the power of generative Artificial Intelligence (AI). This tool does more than speed up old tasks. It changes the rules completely. How is this smart technology reshaping a powerful, complex industry?

Let us break it down.

First, What is Investment Banking?

Not all banks are the same. A bank on your street corner handles savings accounts and personal loans.

These are very different from the banks on Wall Street. Investment banks are financial firms. They help large companies, governments, and other big groups with huge financial deals.

For example, they are the planners behind major transactions. One major deal is a merger or acquisition (M&A). This is when one company buys another.

Furthermore, they help private companies sell shares to the public for the first time. This process is an Initial Public Offering (IPO).

Here’s a simple breakdown of the different types of banking:

| Type of Bank | Who are the Main Clients? | What Do They Do? |

| Retail Banking | Individuals and families | Savings/checking accounts and personal loans |

| Commercial Banking | Mid-sized businesses | Business loans and services |

| Investment Banking | Large corporations | Helping companies merge, acquire others (M&A), or sell stocks for the first time (IPOs) |

A high-stakes, data-heavy field like investment banking is the perfect place for powerful new technology to make a massive impact.

A Super-Smart Assistant for Bankers

AI has served banks for years, but its role has changed fast. It grew from a basic tool into a creative partner. Each new step made the tech more powerful.

- Early Automation: At first, AI acted like a simple clerk. It handled basic tasks and back-office work. This cut down on paperwork and boosted speed. These tools excelled at dull, repetitive jobs. However, they could not make hard choices.

- Algorithmic Trading: Later, AI grew smart enough to trade. Programs began to scan market data in real time. They spotted trends and finished trades instantly. No human could match this speed. This gave banks a massive edge in the market.

- Generative AI: The newest shift changes everything. Old AI could read a book, but Generative AI can write the sequel. This tech builds new, human-like content. It drafts reports, writes emails, and builds slide decks. It even writes computer code. Today, AI acts as a partner rather than just a tool.

Now, let’s see how this incredible technology is being put to work on the job.

AI on the Job

AI is not just a single tool; it’s more like a team of highly specialized assistants, each designed to help bankers with a different part of their job.

Trading and Market Analysis: Finding the Needle in the Haystack

In trading, speed and data are everything. AI systems analyze vast amounts of data. This includes financial reports, news, and social media. AI finds patterns and predicts market changes that people miss. Then, AI executes trades in microseconds based on this analysis. For instance, JPMorgan Chase developed a tool called IndexGPT. It is a type of ChatGPT for investing that helps with this process. Clearly, the main benefit is simple: AI helps banks trade smarter and faster.

Making Deals and Helping Clients: The AI “Co-Pilot”

When it comes to advising clients and making deals, generative AI is acting as a powerful “co-pilot” for bankers, helping them prepare materials and deliver personalized advice faster than ever.

- Generating Pitch Books: Bankers create pitch books to win new business. These presentations outline specific deals or financial strategies. AI now generates the first draft of these complex files. This technology saves analysts 30% of their work time. This shift does more than finish tasks faster. It frees up the bank’s smartest minds to focus on strategy, build stronger client relationships, and invent new financial ideas that can earn millions.

- Speeding Up Due Diligence: “Due diligence” is the critical process of doing your homework on a company before a major deal. It involves checking for financial or legal risks buried in thousands of documents. AI can scan all of these documents for potential issues, reducing the time spent on this process by over 50%.

- Providing Personalized Advice: AI is also enhancing how advisors interact with clients. Morgan Stanley, for instance, uses an OpenAI-powered tool that can summarize meeting notes, draft follow-up emails, and suggest ideas. This gives financial advisors more time to focus on strategic conversations and building strong relationships with their clients. This is happening across the industry, with specialized tools like BondGPT that can answer complex questions about the bond market in plain English.

Playing by the Rules: The Digital Detective

The banking industry is governed by very strict rules to prevent financial crimes like fraud and money laundering. AI has become an essential tool for ensuring compliance with these regulations.

| Task | What it Means & How AI Helps |

| AML & KYC | Anti-Money Laundering & Know Your Customer. AI acts like a detective, scanning transactions in real-time to spot suspicious activity and verifying customer identities much faster than a human could. |

| Regulatory Monitoring | Laws for banking are constantly changing. AI reads all the new rules and helps the bank generate reports to prove it’s in compliance, reducing human error. |

By making banks faster, smarter, and safer, AI’s impact isn’t just about daily tasks; it’s changing the entire financial scoreboard. Let’s look at the big wins.

What Are the Big Wins?

The strategic advantages of integrating AI into investment banking are significant, leading to major improvements in how banks operate.

- A Massive Productivity Boost: Generative AI is predicted to boost the productivity of a front-office banker at one of the world’s top firms by 27-35%. This means bankers are freed from tedious, repetitive work like drafting standard reports and can focus on more creative and high-value tasks, such as building client relationships and developing innovative financial strategies.

- Faster, More Accurate Decisions. Unlike humans, AI can analyze enormous amounts of data without getting tired or making mistakes. This leads to fewer errors in financial analysis and more accurate predictions about market trends, helping banks make smarter, data-driven decisions.

- Reduced Costs and More Profit. By automating tasks and improving efficiency, AI is set to make a big financial impact. It’s estimated that AI could increase operating profits across the banking industry by 9% to 15%. This means banks can operate more leanly while increasing their profitability, a win-win that drives further investment in technology.

But with great power comes great responsibility, and AI is not without its challenges.

The Challenges and Risks

While AI is incredibly powerful, it’s not a perfect solution. Banks must navigate several key risks as they adopt this technology.

| Risk | Simple Explanation |

| Algorithmic Bias | AI learns from data created by humans. If historical data shows bias, for example, in who got approved for loans in the past, the AI can learn and repeat those unfair decisions. |

| Data Privacy & Security | Banks handle extremely sensitive financial information. Using AI means this data is processed more frequently, increasing the risk of it being hacked or leaked. |

| “Hallucinations” | Sometimes, generative AI can confidently make up completely false information. In the high-stakes world of finance, this could be a disaster if not caught by a human expert. |

| High Costs & Environmental Impact | Training these huge AI models requires massive amounts of computing power, which is costly and consumes a lot of energy, contributing to a large carbon footprint. |

As the industry works to address these challenges, the future of AI in finance appears even more promising.

What’s Next? The Future of Finance

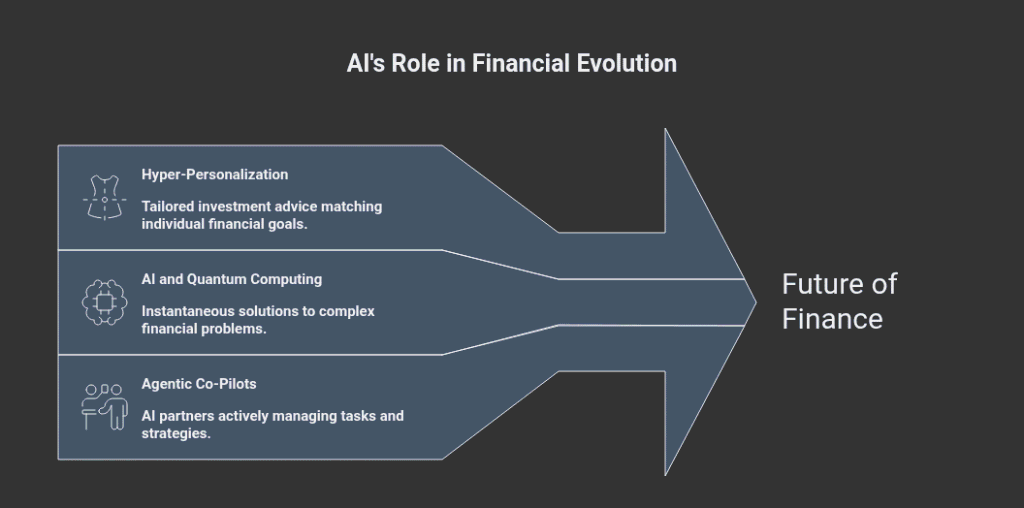

The integration of AI in investment banking is just getting started. Here are a few trends that could define the future:

- Hyper-Personalization: AI will soon tailor investment advice to your specific goals. It will match your risk level perfectly. Think of it like a movie recommendation for your money. This shift brings elite service to every client.

- AI and Quantum Computing: AI acts like a brilliant brain. Quantum computing acts like a lightning-fast engine. When they join, they solve massive financial problems instantly. For example, they can map global market shifts in seconds.

- Agentic Co-Pilots: AI has evolved from a basic tool into a teammate. These agentic co-pilots now manage their own tasks. Soon, they will build complex strategies alongside bankers. They will act as active partners rather than simple assistants.

Conclusion

AI is changing investment banking. It does not replace humans. Instead, it improves them.

Software now handles boring chores. It finds deep patterns and finishes hard math fast. These tools free bankers to focus on big goals. They can now spend more time meeting clients and creating new ideas.

This blend of people and machines builds a faster industry. The future of finance looks bright.